We’re excited to spotlight Cameron McCarthy, Co-founder & CEO of WeStock.

Hear what drives him and why he had to start WeStock.

We’re excited to spotlight Cameron McCarthy, Co-founder & CEO of WeStock.

Hear what drives him and why he had to start WeStock.

We’re excited to spotlight Randi Bushell, Co-founder & CEO of Merri.

Hear why she started Merri, what drives her, and how she’s going after having it all.

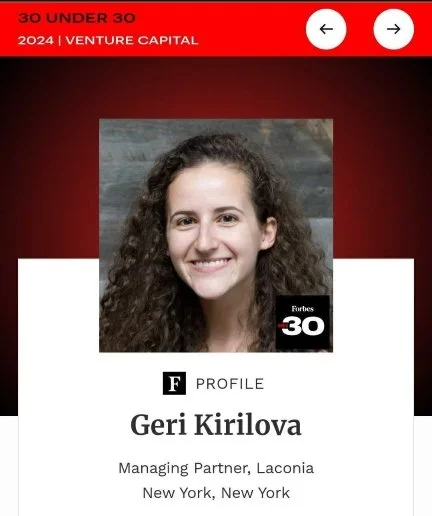

We are thrilled to share that our Managing Partner Geri Kirilova has been included in the Forbes 30 Under 30 list for venture capital!

She joins a stellar group of 30 Under 30 honorees including our portfolio founders Sam Bobley (Ocrolus), Dan Pantelo (Marpipe), and Kelsey Hunter (Paloma).

Geri has built her VC career not just with a dedication to excellence but also with a tremendous amount of heart. Whether she’s generously advising founders, digging into data, or building programs like the Venture Cooperative to make the industry more accessible, she continues to raise the bar.

Join us in congratulating her!

2023 has been one of the more unusual years of our team’s collective investing experience. Despite its challenges, the current market plays positively to Laconia’s strengths of patient due diligence, sober valuations, and active operationally oriented portfolio management.

The word “jumbled” comes to mind when describing the current venture landscape, particularly at the seed stage. Later stage rounds have succumbed to downward pricing pressure from the macro environment of higher interest rates, limited liquidity potential, and political uncertainty, both foreign and domestic. Cash preservation, breakeven operating objectives, and team efficiency are taking precedence over the “grow at all costs” mentality that had dominated the venture world during the past few years.

Yet, seed stage financings remain on the high side, especially in the first half of the year. Some of this can be explained by the effect of the larger funds that had robustly entered the early stage. Pitchbook has a recent good summation of this:

Deal metrics have fallen for most VC stages since the market peaked in 2021, but one part of the US VC ecosystem bucked the trend: seed. The youngest companies’ valuations and deal sizes were propped up in large part by large investors whose participation at the stage exploded during the pandemic boom. Large investors accounted for more than a third of seed deal value in 2022, but their involvement at the stage is starting to recede.

A larger driver of large rounds and high valuations may also be the declining deal counts at the pre-seed and seed stages:

Regardless of causes, we know good deals are still out there, and we're willing to wait for the right ones. With new investments, we are as attentive as ever to the key milestones that they have to achieve, especially given the funding slowdown at Series A and beyond.

Despite best efforts, we know that the nature of the venture business is such that not all companies survive. We have a sober view of the challenges ahead and continue to work closely with all founders in our orbit on navigating the market turbulence.

We would like to add a word about AI, which we are seeing presented more and more in company pitches as well as within our own portfolio companies. Our portfolio founders have typically paid close attention to AI’s development for years. And our view is with the consensus: AI will be world changing-over the next 10+ years. New AI-enabled platforms will replace many of what will then be legacy software; the dynamic cycle of digital tech never stops, which much of our investment thesis is predicated upon.

Given the above, we are not avoiding investing in AI; rather, we are focused on AI’s value to customers vs. funding AI for AI's sake. The tech world seems to be at an inflection point similar to 2001-2004. The first phase of Web 1.0 during the 1990s built the infrastructure that Web 2.0 companies built upon after that period’s investment bubble burst.

History has shown that in tough times, iconic companies emerge and flourish:

Founded 1998-2004: Paypal, Salesforce, LinkedIn, Tesla, Tableau, Facebook

Founded 2007-2010: Airbnb, Dropbox, WhatsApp, Slack, Square, Uber, Stripe, Warby Parker, and many more.

Despite the jumble, we are bullish.

Ocrolus, the leading human-in-the-loop infrastructure company that transforms documents into actionable data with over 99% accuracy, today announced that it has been named to the annual Inc. 5000 list as the 30th fastest growing private company in America. The company ranks as the fastest growing software company in New York and the sixth fastest growing software company nationwide.